Over the past decade, Kenya has emerged as one of the most influential fintech ecosystems not just in Africa, but globally. Often referred to as the continent’s “Silicon Savannah,” the country continues to push the boundaries of digital finance through progressive regulation, widespread mobile connectivity, and a vibrant innovation culture.

As the undisputed global leader in digital finance adoption, Kenya’s mobile money usage has reached 91% penetration across the population. Regulators like the Central Bank of Kenya and the Capital Markets Authority are accelerating this growth through regulatory sandboxes, open finance initiatives, and modernized licensing frameworks that support both established institutions and emerging fintech players.

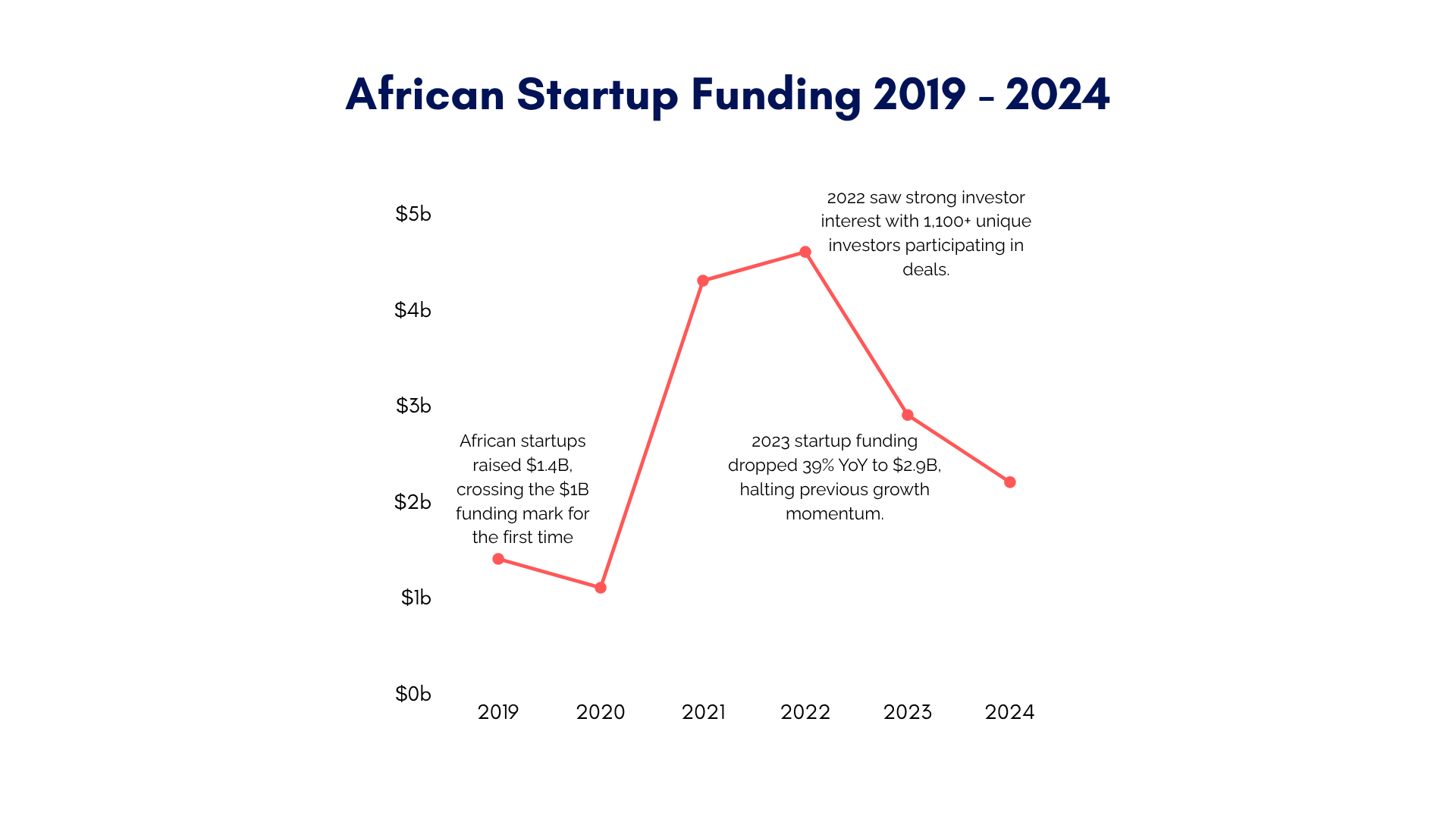

The nation’s fintech ecosystem has rapidly diversified beyond payments into lending, insurtech, wealthtech, embedded finance, and digital infrastructure. With strong investor interest, an entrepreneurial startup culture, and government-backed digital transformation initiatives, Kenya is cementing its position as a gateway for fintech innovation across East Africa.

Against this dynamic backdrop, Tradepass is proud to present the 8th edition of the World Financial Innovation Series (WFIS) in Nairobi. The event will convene 500+ senior technology and business leaders from the leading banks, insurance providers, microfinance institutions, and fintech disruptors to explore the next frontier of financial services innovation.